58+ formula to calculate principal and interest on a mortgage

Web Take your total outstanding balance on your mortgage or any other loan. Apply Now With Quicken Loans.

58 Real Estate Terms Every Agent Needs To Know In 2023 Rentspree

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

. Lock In Your Low Rate Today. Web To find out the interest portion of our mortgage payment follow the below instructions. Ad Calculate and See How Much You Can Afford.

Then take your annual interest rate and divide by 12 to find your monthly interest rate. In theory that interest rate is being multiplied by a shrinking principal balance. Web The basic formula for calculating your mortgage costs.

Web Use this mortgage formula and plug in the appropriate numbers. Web To use the effective annual rate formula below convert your interest rate from a percent into decimals. How Much Interest Can You Save By Increasing Your Mortgage Payment.

Simple Interest principal rate of periods For example you invest 100 the principal at a 5. Apply Now With Quicken Loans. See If You Qualify for Low Down Payment.

Estimate your monthly mortgage payment. Web Notice how one of the variables is loan balance. Are You Eligible For The VA Loan.

Web To calculate simple interest use this formula. Mortgage Effective Annual Rate 1 frac. Ad See how much house you can afford.

Web From the above scenario we have some data in our hands to calculate the Principal and Interest for a given loan for a given period of time. Initially type the below formula in Cell C5. Ad Calculate Your FHA Loan Payment Fees More with an FHA Mortgage Lender.

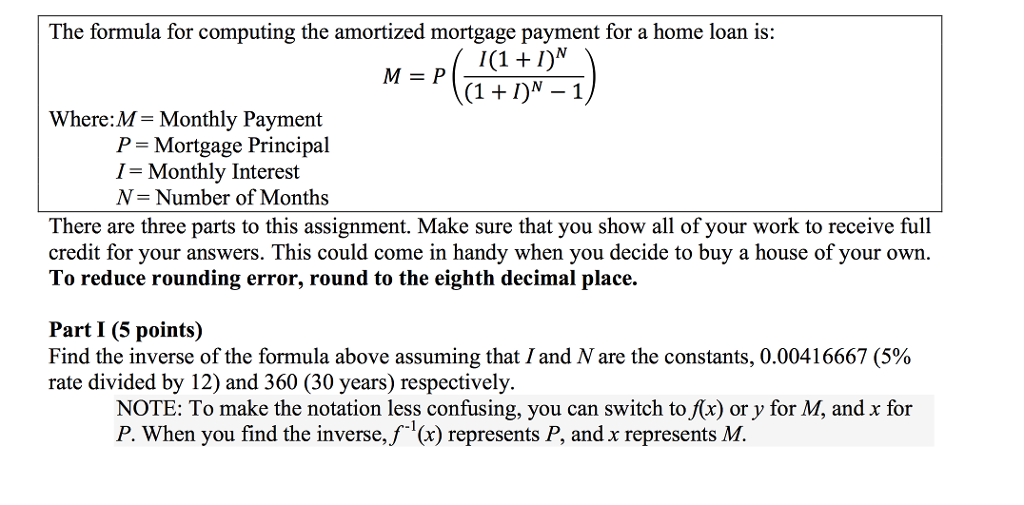

Ad Compare Mortgage Options Calculate Payments. That means this formula can be used to show the breakdown between principal and interest for any given month. Web There are five key components in play when you calculate mortgage payments Principal.

Ad Compare Mortgage Options Calculate Payments. The amount of money you borrowed for a loan. What More Could You Need.

Web Calculating your interest payment requires a little more math. P A P stands for your monthly payment A stands for your loan amount T stands for the term of your loan. You may be wondering why your mortgage paymentif you have a fixed-rate loanstays the same from one month to the next.

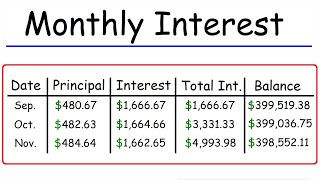

What More Could You Need. The reason thats not the case is that lenders use amortizati See more. Monthly Interest Payment Principal Loan Amount x Annual Interest Rate 12.

So shouldnt your monthly bill get smaller over time. Check Official FHA Loan Requirements. Monthly Payments L where L stands for loan C stands for per payment interest and N is the.

Start By Checking The Requirements.

Franchise Canada Directory 2023 By Franchise Canada Issuu

How To Calculate A Mortgage Payment Youtube

How To Calculate The Monthly Interest And Principal On A Mortgage Loan Payment Youtube

4 Ways To Calculate Mortgage Interest Wikihow

How To Calculate Principal Interest On A Mortgage

58 Real Estate Terms Every Agent Needs To Know In 2023 Rentspree

Mortgage Payment Structure Explained With Example

Mortgage Calculator Wikipedia

Principal And Interest Mortgage Basics Rocket Mortgage

How To Use Formula For Mortgage Principal And Interest In Excel

58 Real Estate Terms Every Agent Needs To Know In 2023 Rentspree

4 Ways To Calculate Mortgage Interest Wikihow

How To Calculate Principal And Interest What Are The Key Tools I Need To Understand

:max_bytes(150000):strip_icc()/analyzing-the-expenses-836794228-5b47a5f746e0fb0037ff1b96.jpg)

How To Figure Mortgage Interest On Your Home Loan

Solved The Formula For Computing The Amortized Mortgage Chegg Com

How To Calculate Principal And Interest What Are The Key Tools I Need To Understand

4 Ways To Calculate Mortgage Payments Wikihow